- In this first year of the 2021-2025 Strategic Plan we have set the path for achieving the goals we have established for ourselves.

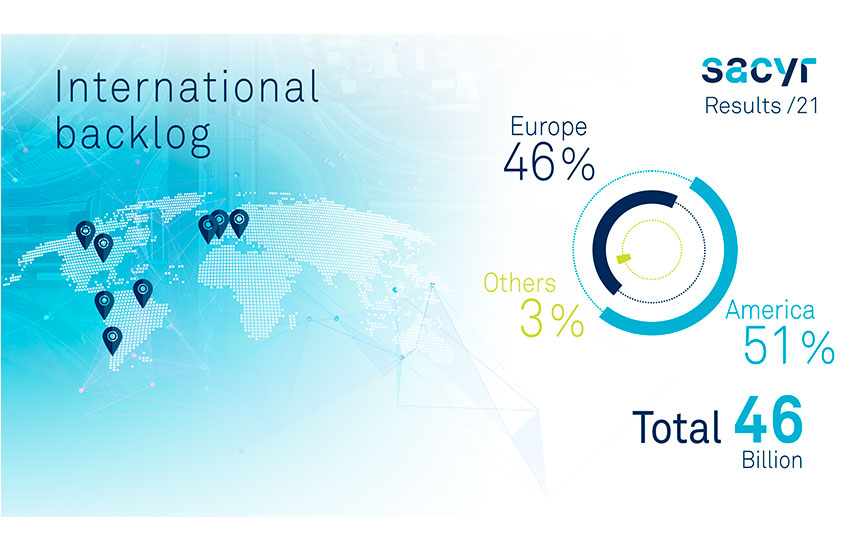

- In 2021, the EBITDA increased to € 923 million (+28%), the revenue backlog reached nearly € 46 billion, and net recourse debt was reduced by 19%

The excellent work done by the more than 46,000 Sacyr professionals in 2021 is reflected in the financial results for the year. The first year of the 2021-2025 Strategic Plan ended with a 28% EBITDA increase, to € 923 million.

This significant growth is due to good business results and our focus on P3 projects. In 2021, 83% of the EBITDA came from P3s with low demand risk.

Revenues grew 3% to roughly € 4.6 billion, and profitability (EBITDA margin) increased to 19.7%, significantly higher than that of 2020 (15.9%).

Furthermore, this growth was achieved in a complex global scenario, amidst the Covid-19 crisis, the increase in energy prices and feedstock, and with great logistical challenges.